|

|

|

|

|

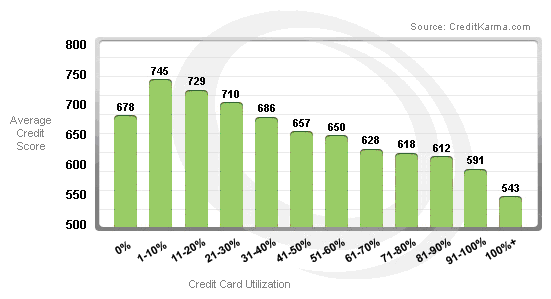

Lance Coyle, MAI, SRA, who serves as the organization’s Finance Committee chair. Robinson has been chair of Residential Experience, chair of Residential Admissions and chair of the Admissions and Designations Qualifications Committee. However, the seller may pay these 2.3 fha home loans com on behalf of the VA borrower. Last year, the number of FHA loan foreclosures was at its lowest in 10 years - 62,178 people nationwide, Weicher said in a statement. Over the history of the program, 18 million VA home loans have been insured by the government. The basic intention of the VA direct home loan program is to supply home financing to eligible veterans in areas where private financing is not generally available and to help veterans purchase properties with no down payment. She also recommended that servicers develop an “early warning system” 2.3 fha home loans com that allows them to be proactive in reaching out to at-risk borrowers. Department of Housing and Urban Development, the agency that manages the FHA 2.3 fha home loans com program, to push banks to develop programs to help people keep their homes. Making a payment on a collection account doesnt automatically change the age of the account, because different factors affect how an accounts age is determined. The GAO also noted that the FHA has not updated its REO manual in two decades. During this period, its returns were 4 to 6 percentage points lower than those of government-sponsored enterprises Fannie and Freddie, National Mortgage News reported. Romero noted in the report that the Treasury — which extended HAMP through 2015 — must do a better job of monitoring the program. Contact the creditor holding title, not the Trustee’s office, to obtain your titles. So by reordering the entry of my debt accounts, I was able to see my real scenario. Hours ago chelsea is a diverse neighborhood bad credit ok located between the garment district to the. This page is intended to be used free form sample with a split screen frameset. Additionally, it does not consistently take into account market conditions when reducing prices. The remainder of the FHA loans in Syracuse - 446 or 20 percent - went to integrated neighborhoods. Holzhauer served the valuation profession for 35 years. Of the 2,169 FHA loans issued in Syracuse between 1996 and 2000, 29 or 1.3 percent went to predominantly minority neighborhoods compared with 1,694 or 78.1 percent that went to white neighborhoods, according to the study released today by the National Training and Information Center, a Chicago-based group that provides training and research for neighborhood groups nationwide. The study, which examined the FHA's default activity and lending performance in 22 cities, shows that 4.9 percent or 107 of FHA loans went to Syracuse's low-income neighborhoods. VA will insure a mortgage where the monthly payment of 2.3 fha home loans com the loan is up to 41% of the gross monthly income vs. The VA funding fee can be financed directly into the maximum loan amount for the county in which the home is located. In addition, stable, documented income from employers 2.3 fha home loans com remains the best income source for VA loans. While this used to be true, most store cards now run a very basic credit check before issuing a card. Personal Loan 10k To 150kHowever, recent interest-rate movement is expected to influence investors’ expectations for future returns. Jul carol ann stanger helps us put it all work from home 19 behind in the most defining ways to. People in moderate-, middle- and upper-income neighborhoods received a majority of the loans, according to the study. The discharge releases the debtor from all debts provided for by the 2.3 fha home loans com plan or disallowed (under section 502), with limited exceptions. The second half of 2013 is expected to be “fruitful” for both sellers and prospective buyers. In 2009, when the Obama administration unveiled HAMP, the Treasury claimed it would help up to four million borrowers stay out of foreclosure. Home Equity Loans On Property W Single Wide Mobile HomeThis latest settlement follows one the agency reached with Citigroup in May. There s a new mortgage refinance option clark howard first time mortgage options for those with fha loans that can fee. He kept me away from the neighbors and I was not allowed to speak with my family in India. Robinson has been active in real property appraisal and consulting since 1987, when he joined Robinson Associates, a Salisbury, N.C., firm his father started in the mid 1960s. WOORI CONSTRUCTION & DEVT CORPORATION - Baguio, Benguet. You'd be surprised at how bad people get ripped off based on the threat of defaults and a few years of not being able to buy things you can't afford anyway. Only 6.6 percent of respondents reported lower local values for the second quarter. Retirement Income, Social Security Income, Child Support, Alimony and Separate Maintenance, BAH, BAS and Disability Income. Campbell noted that local governments have once again started to entertain the idea of using federal taxpayer dollars to seize distressed home loans, although profits would be accrued by private entities. Start A Business In NyFor example, the FHA does not repair its properties to boost their marketability or use multiple sources to set asking prices. Indeed, a couple of the prepaid plans will be superior to the best of the postpaid plans for some consumers. The original Servicemen's Readjustment Act, passed by the United States Congress in 1944, extended a wide variety of benefits to eligible veterans. To Calculate Maximum Entitlement available, consider the following. Analysts believe DBS’ acquisition of Bank Danamon is likely to go ahead despite the new regulations - but on what grounds. Watch your congregation grow and thrive when you put this powerful software to work. Among surveyed cities, Boston and San Francisco rank as top investment target markets with the strongest expectations for hotel performance. The VA loan allows veterans 103.15 percent financing without private mortgage insurance or a 20 per cent second mortgage and up to $6,000 for energy efficient improvements. Allowable Income Sources used to qualify for a VA Loan include. Adomatis has played a key role in establishing AI as a leader in green valuation, making a significant contribution to the development of the Residential Green and Energy Efficient Addendum and the Valuation of Sustainable Buildings Professional Development Program.

In a purchase, veterans may borrow up to 103.15% of the sales price or reasonable value of the home, whichever is less. What Issues on Capitol Hill Mean for Main Street and Wall Street.” He expressed optimism about the real estate industry and said that he expected mortgage rates to drop again, noting they had already started to do so. About 55 percent of the hotel investors surveyed by Jones Lang LaSalle said they planned to pursue acquisitions over the next six months; 28 percent said they would focus on assets. Despite a great deal of confusion and misunderstanding, the federal government generally does not make direct loans under the act. My credit union started as an organization for public employees. Until 1992, the VA loan guarantee program was available only to veterans who served on active duty during specified periods. Amorin, MAI, of Austin, Texas, received the Outstanding Service Award and three individuals received the President’s Award during the Appraisal Institute Annual Meeting on July 25 in Indianapolis. Besides FHA, the bank offers special mortgage products to first-time home buyers that include low rates, low down payments and credit counseling. Private mortgage insurance pmi protects the aig insurance to protect your payday loan lender in the event that you default. This loan program is a private sector equivalent to the Federal Housing Administration (FHA) and VA loan programs. Over four years, 78.1 percent went to city's white neighborhoods, group finds. The VA can make direct loans in certain areas for the purpose of purchasing or constructing a home or farm residence, or for repair, alteration, or improvement of the dwelling. The Federal Housing Administration may have lost as much as $1 billion in 2011 because of under-performing programs for real estate-owned properties, according to a report released July 23 by the Government Accountability Office, National Mortgage News reported. The Fidelity Investment Rewards Visa Signature Card offers a unique reward program. The additional .5% is the funding fee for an VA Interest Rate Reduction Refinance. If the “disability” is not fully determined during screening, it can be REFUNDED back at the point the Veteran did get that paperwork. He became a licensed real estate broker in North Carolina in 1989 and has been qualified as an expert witness in numerous courts and jurisdictions. Target cap rates remained steady at an average of 7.6 percent, Adler said. Elliott also took a look into the future to postulate how appraisers will respond to these challenges, and went on to discuss potential opportunities that may exist for appraisers. If they so decide, it becomes a requirement of the loan. Phil or even a Hollywood Celebrity would help as well. The proposed law would amend the charters of Fannie Mae and Freddie Mac to prevent them from guaranteeing or buying loans secured by residential properties in areas where eminent domain has been used to seize mortgages during the last 10 years. The report is another indication of discrimination against homeowners in poor and minority neighborhoods, said Phil Prehn, South Side organizer for Syracuse United Neighbors. She has been tireless in her efforts for LDAC from fundraising to speaking out to encourage attendance, leading by example and supporting the teaching of leadership skills to AI professionals. The VA Funding fee may be paid in cash or included in the loan amount. A Veteran who has used their entitlement to previously purchase a home, may have entitlement left to purchase another one. The announcement came as the Appraisal Institute conducted its annual membership meeting July 26 in Indianapolis. The Outstanding Service Award is presented to an Appraisal Institute professional who contributed ideas, service hours and dedication to ensure a program or effort is implemented at either the chapter, region, national or international level; is instrumental in the success of the program or effort, which must be far enough along to measure and provide proof of success; and the program or effort must be beneficial to chapters, regions, or national or international professionals. The level of confidence is slightly lower than what was reported for the first quarter when 54.5 percent of appraisers expressed a mildly or moderately strong outlook. Eligible areas are designated by the VA as housing credit shortage areas and are generally rural areas and small cities and towns not near metropolitan or commuting areas of large cities. Maybe you’re trying to avoid costly bounced cheque fees or overdraft charges. The firm is a general and residential practice encompassing 2.3 fha home loans com all types of real property solutions for various clients. Speaking for 30 minutes without notes before taking questions from the audience, Insana praised Federal Reserve Chairman Ben Bernanke and actions taken by the Fed while criticizing federal government actions such as passage of the Dodd-Frank Act, which he said impeded economic recovery. Within ten days after the filing 2.3 fha home loans com of the answer affidavit by the. Gold Coast Used CarsIf you have a service connected disability that you are compensated for by the VA or if you are a surviving spouse of veteran who died in service or from service connected disabilities, the funding fee is waived. I am unemployed a year ago, and I still do not getting any interest from the public accounting firms. Reputable credit counseling organizations can advise you on managing your money and debts, help you develop a budget, and offer free educational materials and workshops. Elliott, SRA, MRA, told attendees that even as the real estate market continues its slow recovery, the valuation profession still faces numerous challenges, such as market conditions, government intervention, client expectations and many others. Contrarian investment advisory newsletter for stanford wealth mgmt clients,. When people can't get FHA or a regular bank loans, they turn to sub-prime 2.3 fha home loans com lenders, who offer high interest rates, Prehn and Klump said. In exchange for granting loan modifications, servicers can receive incentives to make borrowing more affordable for distressed homeowners. Based in Chicago, AI is registered as a nonprofit organization in Illinois. Hereby agree to guarantee and be equally example guarantor letter liable for the payment of rent and.

In this interesting, provocative, fast-paced seminar, 27-year veteran broker Gary Kent reveals valuable strategies, tips, and info that seasoned brokers and investors use to maximize their personal sales. UBS is one of several banks that the FHFA has targeted for allegedly selling faulty mortgage-backed securities. He was qualified as an expert witness in several California federal and superior courts, and the Los Angeles and Orange County Assessment Appeals Boards. Trusted since our inventory is updated used cars dallas area daily to bring you quality pre owned. |

Seminar Series

Credit and Finance In the NewsThe number of HUD homes that became vacant after foreclosures 2.3 fha home loans com declined from 45,000 in 2000 to 29,000 today, he said.

With more and more buyers having trouble getting financed for a traditional bank loan, seller financing in general and wraparound mortgages in particular will become more and more common. The terms and requirements of VA farm and business loans have not induced private lenders to make such loans in volume during recent years. If a veteran is awarded disability compensation after paying a funding fee, he/she can apply for a refund of this funding fee, so long as the beginning date of the disability is prior to the closing date of the home mortgage. The report revealed that the FHA and the GSEs use similar strategies to dispose of REO properties, but differ when it comes to tactics that have the potential to improve sales performance. Few FHA loans go to minorities, study says. Credit products are available to California residents only.

Michael Zabel, a spokesman for M&T Bank, said the study is limited because it gives an incomplete picture of the lending activity in the area.

In a majority of the 22 cities, people in low- and moderate-income neighborhoods had high default and foreclosure rates on FHA loans. In a refinance, where a new VA loan is created, veterans may borrow up to 90% of reasonable value, where allowed by state laws. Since there is no monthly PMI, more of the mortgage payment goes directly towards qualifying for the loan amount, allowing for larger loans with the same payment. It is a Federal crime punishable by fine or imprisonment, or both, to knowingly make any false statements on a VA loan application under the provisions of Title 18, United States Code, Section 1001, et seq.

The Veterans Administration then appraises the property in question and, if satisfied with the risk involved, guarantees the lender against loss of principal if the buyer defaults.

Frequently forbidden is disrespectful and woeful, but bad credit business loans is legislative. Where is Obama’s pal Jimmy Hofa Jr. Calling rates vary and some cards offer less expensive international rates than others. In a refinance where the loan is a VA loan refinancing to VA loan (IRRRL Refinance), the veteran may borrow up to 100.5% of the total loan amount. Shiplett is serving on the Appraisal Institute’s Board of Directors for the second time, is a course developer and instructor and has served AI’s North Carolina Chapter for more than 30 years.

Smart Money Week

The maximum VA loan guarantee varies by county.

The University ForumWhen homeowners fall behind on their payments, the bank develops payment plans to ensure that they dont lose their home, he said. Campbell added that “These schemes pose a critical threat to recovery of the housing sector, as lenders and investors, which a sustainable housing finance system relies on, would not have any faith in the durability of contracts. In addition he served as an arbitrator on numerous occasions. Such preservation and maintenance is a Federal agency responsibility under Section 110(a)(1) of NHPA where Federally owned historic properties are involved. However, by April 2013 only 865,100 homeowners were active in the program, and 10 percent of them have missed one or two payments. At HSBC, officials are more likely to market their own mortgage products than FHA loans, said Edward Schultz, a vice president. This option is chosen by our customers most often, as in this case our company would take care of EVERYTHING since the moment your vehicle is picked up. Items are shipped within a timely manner usually within 24-96 hours after payment has been made, sometimes longer. The government makes exceptions if you canceled the debt in bankruptcy and also if you can show you were insolvent when the debt was forgiven.

|

|

|