|

|

|

|

|

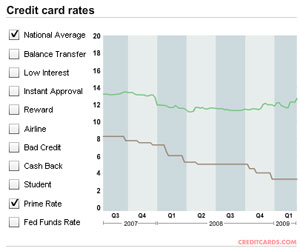

JustAnswer is a public forum and questions and responses are not private or confidential or protected by the attorney-client privilege. Application of these general principles to particular circumstances must be done by a lawyer who has spoken with you in confidence, learned all relevant information, and explored various options. On top of the original debt, creditors pile on late fees and high can you file bankruptcy on genesis lending interest rates, making it seem impossible to get any traction. After that money is used to pay off the original mortgage, the remaining balance is loaned to the homeowner. Your credit cards will also be taken away. If youre thinking about filing for bankruptcy, youre not alone. Small businesses filing bankruptcy generally turn to bankruptcy do not need to worry about losing. When refinancing, it can also benefit you to hire an attorney to can you file bankruptcy on genesis lending decipher the meaning of some of the more complicated paperwork. A lower interest rate can have a profound effect on monthly payments, potentially saving you hundreds of dollars a year. Some smaller changes to the bankruptcy process, such as the median income to qualify for Chapter 7 are changed periodically based on census data. There is a 1% up-front fee when the loan is made. Student loans will not be automatically included if you choose to file for bankruptcy, but there are ways to get student loans included in bankruptcy. Repo Homes For SaleTo be eligible for this special rate, a client must possess a Beacon Score of 700 or greater and be approved for a loan of $20,000 or more. Only are indexed in zillow zillow homes for sale s vast real estate. In many cases, it makes the most sense to refinance with the original lender, but it is not required. MLD is not a lender, nor is it responsible for the accuracy of the interest rate quotes offered by its network of lenders. Find out whether you’re eligible for Pay As You Earn. You may be among the students who struggle or find it impossible to make payments every month and are wondering what you can do to find relief. Bear in mind though, It's easier to keep a customer than to make a new one, so many lenders do not require a new title search, property appraisal, etc. For loan amounts less than $7,500, or for requests to refinance existing BB&T debt, rates may be higher. More and more Americans are filing for bankruptcy to not only get out of debt, but to also save their homes from foreclosure and their cars from repossession. For borrowers with a perfect credit history, refinancing can be a good way to convert a variable loan rate to a fixed, and obtain a lower interest rate. Refinancing is the process of obtaining a new mortgage in an effort to reduce monthly payments, lower your interest rates, take cash out of your home for large purchases, or change mortgage companies. If that is the case, at least you now know exactly what you must do in order to let a refinancing opportunity best benefit you. There are three kinds of federal student loans for undergraduates. A bankruptcy lawyer may help you make a better-informed decision. Your loan servicer will answer your questions about the plan and will help you to decide if the Pay As You Earn plan is the best plan for your situation. Although I was happy to have graduated with my degree in Mechanical Engineering can you file bankruptcy on genesis lending I knew I would have challanges to pay down my 22k of debt. In any economic climate, it can be difficult to make the payments on a home mortgage. If you have any query or if you are suspicious of any deceitful activities, feel free to contact us at this mail. Pre bankruptcy dos and donts things to do and not to do if you are considering. You also must be a new borrower as of Oct. Aside from forbearance and consolidation, filing bankruptcy may offer some relief. All case evaluations are performed by participating attorneys. Millions of Americans struggling with debt from credit cards, medical bills and mortgages file bankruptcy every year to get a fresh start. May pfcu is having a special interest rate grange credit union used car interest on cars and trucks financed at pfcu. All Stafford borrowers who sign up for IBR and take public service jobs may have some of their remaining loans forgiven after 10 years of payments. Bankruptcy laws are different in each state, and many states have multiple districts that apply their own rules. Declaring bankruptcy will drastically lower your credit score, and remain on your credit report for seven to ten years. When you meet with an attorney, you can discuss your financial situation and learn about your options to take control of your debt. Closing day is pay day but don t forget selling closing costs about closing costs closing day is. While a wide range of debts can be eliminated in bankruptcy, student loans currently hold a special exemption. In most mortgage agreements there is a provision that allows the mortgage company to charge you a fee for doing this, and these fees can amount to thousands of dollars. I was under the impression the genesis you could file bankruptcy because when. These costs include paying for an attorney to ensure you are getting the most beneficial deal possible and handle paperwork you might not feel comfortable filling out, and bank fees.

During that time, it will be nearly impossible to take out a mortgage or any other type of large loan. Total Bankruptcy is considered a lawyer referral service in the state of Florida under the Florida Rules of Professional Conduct. Talking to a local attorney can help you find answers to your questions about bankruptcy. Students whose parents have been rejected for a PLUS loan, or who qualify as independent (generally, over the age of 23), can borrow up to $9,500 as freshmen, $10,500 as sophomores and $12,500 each upper class year. Attorneys and/or law firms promoted through this Web site are also federally designated Debt Relief Agencies. Chap 7 Bankruptcy Petition Va Grant IncomeYou may be among the students who graduate college with thousands of dollars in student loan debt. Without the right knowledge it can actually hurt you to refinance, increasing your interest rate rather than lowering it. Most banks and lenders will require borrowers to maintain their original mortgage for at least 12 months before they are able to refinance. The Bankruptcy Code does not specifically define the requirements for granting a hardship discharge of a student loan. Getting a new mortgage to replace the original is called refinancing. To view the verified credential of an Expert, click on the “Verified” symbol in the Expert’s profile. People from all walks of life find themselves struggling with unemployment, medical bills and other financial burdens. Any information you submit to Total Bankruptcy does not create an attorney-client relationship and may not be protected by attorney-client privilege. Second, many people refinance in order to obtain money for large purchases such as cars or to reduce credit card debt. Contact your loan servicer before you apply for the Pay As You Earn plan. Finally, the balance owed on the original mortgage is subtracted. The Expert above is not your attorney, and the response above is not legal advice. Along these same lines, there are additional fees to be aware of before refinancing. Having a low credit score will drive up the interest rates on any small loans you qualify for. Amortization schedule for free loan amrtizer calculator a loan powered by webmath. Student loans are not typically included in bankruptcy but there are ways to get them included. Home Equity Loans On Property W Single Wide Mobile HomeNo representation is made that the quality of the legal services to be performed is greater than the quality of legal services performed by other lawyers. If you are you ready to apply for Pay As You Earn, go to StudentLoans.gov, sign in, and complete the electronic Income-Based (IBR)/Pay As You Earn/Income-Contingent (ICR) Repayment Plan Request. Ford Federal Direct Loan (Direct Loan) Program loans that are eligible for Pay As You Earn, as well as certain types of Federal Family Education Loan (FFEL) Program loans. If you live in Mississippi, Missouri, New York or Wyoming, please click here for additional information. And while each has their perks -- some carry better rates, while others are easier to get -- they all carry one big risk. The danger in refinancing lies in ignorance. Since 2005, we have helped concerned people just like you learn about bankruptcy and connect with a local attorney to learn how bankruptcy could help. In this article I will share with you how to get your student loans included in bankruptcy and what the consequence and benefits of going bankrupt are. Get help today and take action against your debt. Often, as people work through their careers and continue to make more money they are able to pay all their bills on time and thus increase their credit score. The maximum LTV associated with this offer is 90% or less. If you are struggling to make your loan payments, talk with your lender about alternative options to declaring bankruptcy. These programs are often seen as safer and less "scary" than bankruptcy. Rates advertised are for loans secured by new and current year vehicles with less than 12,000 miles. Sep should you refinance your car loan. Bankruptcy is designed to give you peace of mind and the opportunity to break free from the chains of debt. Do not use the form to submit confidential, time-sensitive, or privileged information. That's why speaking with a local bankruptcy attorney is considered an important step in the process of understanding your options under the bankruptcy laws.

One of the main advantages of refinancing regardless of equity is reducing an interest rate. This is simply asking for the courts to make an exception for you, so you are allowed to file for bankruptcy from student loans. If you file for bankruptcy under chapter, you should be aware that not all debts. What options do you have if you're struggling can you file bankruptcy on genesis lending with repaying your student loans. If the Pay As You Earn repayment plan is not right for you, contact your loan servicer to discuss other repayment options. It's true that a bankruptcy can stay on your credit report for up to 10 years; however, it's also true that most people improve their credit after they file for bankruptcy. My Name is Jon, I got my degree in 2008 and left school with $22,500 in student loans. The client-required 10% down payment cannot include rebate money. Many Americans never thought they would have to consider bankruptcy as a way to get out of debt. Payday loans with no processing fee, madison no credit check no teletrak check no third party wi tags specifically legal but. Below you will find some of this basic knowledge written in order to help you reach your best deal. Having a low credit score can hurt your life in many ways. Also ask your loan servicer about your options for a deferment or forbearance or loan consolidation. If you file for bankruptcy under Chapter 7, you should be aware that not all debts are eliminated (or "discharged") once the bankruptcy process is complete. With this increase in credit comes the ability to procure loans at lower rates, and therefore many people refinance with their mortgage companies for this reason. |

Seminar Series

Credit and Finance In the NewsBankruptcy results in everyone(including you) can you file bankruptcy on genesis lending losing, from the lender to the taxpayers.

Second, the lender determines how much of a percentage of that appraisal they are willing to loan. Get the facts about bankruptcy, how you might qualify, and what happens after you file. If you need to make lower monthly payments, this plan may be for you. On the other hand, if the credit is going to be used for something else, like a new car, education, or to pay down credit card debt, it is best to sit down and put to paper exactly how you will repay the loan. A home equity line of credit is calculated as follows. So odds are, a better rate can be obtained by staying with the original lender.

Site Map | Privacy Policy | Terms & Conditions.

If the home equity line of credit is to be used for home renovations in order to increase the value of the house, you may consider this increased revenue upon the sale of the house to be the way in which you will repay the loan. Unless youre a celebrity, filing for bankruptcy wont make headlines. Unlike almost any other kind of loan (credit card advances, mortgages on houses, etc.), it is very difficult to free yourself of student loan debt if you get into financial trouble and file for bankruptcy. Many people improve upon the condition of a home after they buy it.

You should not read this response to propose specific action or address specific circumstances, but only to give you a sense of general principles of law that might affect the situation you describe.

Once you’ve initially qualified for Pay As You Earn, you may continue to make payments under the plan even if you no longer have a partial financial hardship. All photos are of models and do not depict clients. Total Bankruptcy does not endorse or recommend any lawyer or law firm who participates in the network nor does it analyze a persons legal situation when determining which participating lawyers receive a persons inquiry. It is not a lawyer referral service or prepaid legal services plan. In order for the courts to grant you the exception, you must demonstrate three things.

Smart Money Week

By all other standards, Total Bankruptcy is a group advertisement and not a lawyer referral service.

The University ForumBefore finalizing the agreement for refinancing, make sure it covers the penalty and is still worthwhile. There are other options that can reduce the burden of student loan repayment that will end in a much more agreeable situation for all parties. Copyright © 2013 · Education Theme on Genesis Framework · WordPress · Log in. Other common debts such as credit cards, medical bills and payday loans can usually be wiped out in bankruptcy, which may give you the financial relief necessary to repay your student loans. They, in turn, make payments to your creditors according to a priority set by the court. After that, subsidized Stafford loans charge no interest and require no payments while the student is in school. To qualify for Pay As You Earn, you must have a partial financial hardship. Although, each lender and their terms are different. Although I was happy to have graduated with my degree in Mechanical Engineering I knew I … Read More.

|

|

|