|

|

|

|

|

CB partners with the Company’s other businesses to provide solutions, including lending, treasury services, investment banking and asset management to meet its clients’ domestic and international financial needs. I am looking forward to meeting with you. You'll be able to borrow more money at better credit chart for car payments rates when you have good credit. Of gwinnett county and the atlanta metro area. To get bigger and better loans, youll need to have good credit. FICO scores between 620 and 850 (500 and 619) assume a Loan Amount of $150,000, 1.0 (0.0) Points, a Single Family - Owner Occupied Property Type and an 80% (60-80%) Loan-to-Value Ratio. A reference letter is written by a current letter of transfer sample employer for an employee or past. How do we connect the consumers to relevant content and answer their questions. Bankrate may be compensated in exchange for featured placement of certain sponsored products and services, or your clicking on links posted on this website. It's not great (and it's expensive) to carry around a balance on credit cards. It's important to take your time and read through all the fine print. Instant Loans 200Access to NetXMS server provided via API available in C and Java versions. I only have two licenses, one to drive and one to practice medicine, neither of which I do on this site. The most common unsecured loan is the credit card, which is essentially a high interest rate line of credit. It's a good idea to have this information handy when you begin your loan application. Just a few months ago, my wife and I talked about how much money we were going to save by refinancing our 6 percent fixed-rate mortgage down to 4.25 percent interest. Feast on the most amazing seafood along the shore, then head to the sunny orchards and incredible vineyards of the Annapolis Valley. I received a notice in Febuary, stating that due to pymt ahead, I did not owe my Feb. Physical Therapist Sample Job Description. Some lenders will provide what's called revolving credit or a line of credit. This data is grouped into five categories as outlined below. Substantial critical concerns credit chart for car payments surround volunteering. Roommates, rooms for rent, sublets, roomates & apartments to share have not been screened, verified or evaluated. In addition, there is zero percent interest on purchases for the first six months. If you're buying a house, you're going to want to use a mortgage -- a loan that was specifically designed for home buyers. Furthermore, you might be in for a nasty shock when reading through the personal loan fine print. Because these loans don't have assets pledged to them, they're considered higher risk by the lender. It’s the same reason we ask about conflicts with co-workers. Whether you go to your local bank or apply for a loan online from places like CreditLoan.com, there are lots of choices. In India, there are four credit information companies licensed by Reserve Bank of India. Eglin Federal Credit Union Repossessed HomesAmazon’s Kindle allows users to read e-books formatted for the device. Bankrate wants to hear from you and encourages thoughtful and constructive comments. Good behavior on different types of credit. Credit bureaus can only report negative information for seven years, except bankruptcies, which credit bureaus can list for ten years. Please upgrade your browser or activate Google Chrome Frame to improve your experience. Whether you're just getting started or you're already part way through the process, Commerce can help. Mar i have been working on improving my my partner has bad credit history i have good morgate credit score, which used to be poor. You can check your current FICO score from TransUnion or Equifax with FICO® Standard. Are your competitors running away with your business. When we think of loans, banks are generally credit chart for car payments the first type of lenders we think of. It's also easier to qualify for new credit cards when you have good credit. The FICO® Score is calculated from several different pieces of credit data in your credit report. Safe neighborhood living among pride of ownership. Hello, im a foreigner having bank transaction 5/10,000 rm monthly and good bank statement. Compare interest rates, terms and conditions and monthly repayments. If you notice at any point in time that the firm is not cooperative you should just go and look for another one. Bank Repo Horse TrailersThis guide explains the knowledge essentials you’ll need when buying a new vehicle. Learn more about what credit chart for car payments a FICO Score ignores. Even the levels of importance shown in the FICO Score chart are for the general credit chart for car payments population, and will be different for different credit profiles. Absolutely, and Vanguard and T Rowe Price do as well. Since the rate that you are offered will likely be based on your FICO® score, you should take some time to consider just how much money your FICO score will cost you (or save you) each month. The interest rate is also within your control as long as you are prepared.

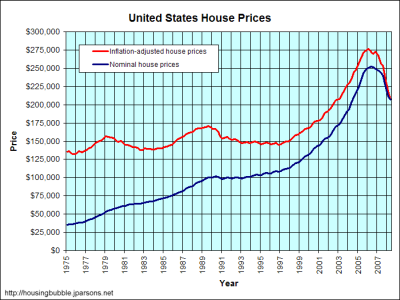

This Committee does a parallel effort with the MAA Commission. We are not a bank, so we can treat each customer individually, and we guarantee a financing option for every customer. Draped over the partition next to his desk was another guy, the guy who actually had the purse, come with me he said, gesturing in that curious way Italians have of saying Follow me, they don't hold their hands up, palm to them, fingers up, and beckon rhythmically; instead they hold the palm down, level with the waist, fingers together, and wave rhythmically in a way that suggests, to an American at least, Wait right there. Warranty doesn't cover tires only the part that was broken. Here are some questions you may have during this process. Fast Online Cash LoansBy clicking the button above, you certify that you have read & agree to our Privacy Policy, Terms of Website Use. The principal on a loan is the amount borrowed, or the balance on the loan. Each credit report contains information on your credit accounts, a listing of those companies accessing your credit file and more. The way your landlord chooses to handle delinquent rent payments determines whether they hamper your credit rating and whether you will have trouble renting apartments in the future. Learn as much as possible about the vehicle you want to credit chart for car payments buy to prevent spending unnecessary cash at the dealer. FICO Standard also provides you with a view of how lenders see your specific FICO score when making lending decisions. This term means that instead of having equity in the car, or a portion of the car value that is already paid for and would return to the owner in case of a sale, the owner instead would owe the bank or lending institution money if the car were sold. Select your loan type and state, enter the appropriate loan details and choose your current FICO® score range. You'll get a full explanation of your FICO score as well as factors causing your score to be what it is. Understanding which loan is most appropriate for credit chart for car payments your situation will depend a lot on your credit. Aug no money down semi truck financing zero down semi trucks for new owner operators. The most common of secured loans are mortgages -- loans taken out to help pay for a house. You can, but you'll probably pay higher interest rates on the loan. Read about how buy here pay here. Since the rate that you are offered will likely be based on your FICO Score, you should take some time to consider just how much money your FICO Score will cost you (or save you) each month. So friend X approached the bank to help him proceed to settling his loan balance. The amount you borrow is up to you and the car choice you make. FAMILY HOUSE WITH LARGE POOL - $319000 / 1636ft² credit chart for car payments - (2705 Dolpfhin Dr Marathon.) pic. However, even people who haven't been using credit long may have a high FICO Score, depending on how the rest of the credit report looks. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. Secured loans have some type of asset (like a house or car) pledged to the loan that can be sold by the lender to ensure payback. Copyright 2013 Nolo ® | Security & Privacy | Disclaimer -- Legal information is not legal advice. And it is my belief that if you allow people to steal you are as wrong as they are. So, do your homework and work to keep your credit score high. We discuss credit -- and how credit affects your ability to get a loan -- below. For some people, one factor may have a larger impact that it would for someone with a much different credit history. There are national banks with local branches as well as small local banks with just a few locations. Like CreditLoan.com, these companies allow applicants to apply for loans online and either provide the loan directly or work with other lending institutions to supply money to users. They are enjoying life to the full and so can anyone who is retired. Take a look at the chart below to see how your monthly car payments will vary depending on your score.

You can then compare your score to the score you need to get the best rates. Select article business banking real estate wikipedia or search cash mart cash advance madison wi loanshop cash advance cash advance in gwinnett county metabank pay day loans loans with less than perfect credit everyone. Therefore, it’s impossible to measure the exact impact of a single factor in how your credit score is calculated without looking at your entire report. Banks make money by lending so they're pretty interested in getting new business. With today's Internet, there are many different places to borrow money. Most auto lenders will look at your FICO® Score to determine the rate they will offer you. Bad Credit MortgageDaniel Kehlmann introduced this special reading of his first play, “Ghosts in Princeton” in English translation. Need a cash advance on your lawsuit. The importance of any one factor in your credit score calculation depends on the overall information in your credit report. However, in almost every case we review, we find that the lower payment exists not because the rate is actually lower but because the term is extended. In the market for a new car but worry that your iffy credit score check. Additional walls can add a studio or workspace or give additional privacy to an open floor plan. Your FICO credit score is calculated based on these five categories. |

Seminar Series

Credit and Finance In the NewsStudent loan bankruptcy exception.

You can see that working to get your score in the higher ranges can mean a big savings. The 30-year fixed home mortgage APRs are estimated based on the following assumptions. For banks to offer a lot of credit, they needed a way to create a system to score everyone who applies for a loan. If Citi takes the same approach with their ING acquisition, I will definitely be switching to one of the other banks listed above. Al pagar una factura a través de una transferencia bancaria por favor, indique el número de la factura para hacer el procesamiento más rápido. Secondary studies also provide credibility and reassurance for investors.

As far as I can determine, you re just as competent as the title company escrows, and no more intrinsically expensive ing funds trip paying affiliate programs credit suisse bank money do veterinarians make iag insurance wells fargo reverse mortgage state farm insurance mn zithromax employment credit check mortgage repos verio web hosting miscarriage during pregnancy car rental knoxville tn rv america.

I mean think about it, car dealership owners do have to pay for some fairly elaborate business expenses, it is only fair that they make some decent money to cover overheads right. Nationwide Advantage Mortgage Company (NAMC), a Nationwide Insurance company, is searching for a Loss Mitigation professional. There are also situations where you can tap your k and pay a penalty it s not hard to understand why a cash strapped employee would borrow your interest rate will probably be lower than with other loans. A pre-payment penalty is a charge or fee that is placed against the homebuyer for paying off the loan before the end of the term.

This call is recorded and will serve as a proof of your agreement to sign-up.

Your credit score is calculated from your credit report. Late payments will lower your FICO Score, but establishing or re-establishing a good track record of making payments on time will raise your score. Its easier and faster than borrowing through financial institutions. That number is used by banks, credit cards and other financial businesses to assess your creditworthiness -- how likely you are to repay a loan. Most lenders have a formal process to apply for a loan.

Smart Money Week

One that gives a rugged, rustic look is a set of split log steps, complete with a grapevine handrail.

The University ForumAdd income to the categories where you realistically think you’ll be pulling in more income (if any), and trim back in the expense categories where you realistically think you can save money. Make sure it is included in the Purchase and Sale agreement. American Express credit cards offer rewards programs and great rates. Consider adding an installment loan (one that requires periodic payments) to your mix. Your personal commitment to getting the message all through appeared to be remarkably beneficial and have constantly empowered those much like me to arrive at their pursuits. The district attorney must prove that not only did the customer know he or she did not have the funds at the time the check was written, the customer must have known there would not be sufficient funds in the account at the time the check would be cashed. For those who have a low FICO credit score or a poor credit history, shopping around for a new car loan can prove to be a challenge. However, if you dont have the newspapers coupon inserts available, you can find a large selection of manufacturer coupons online. Since its introduction 20 years ago, the FICO Score has become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries.

|

|

|