|

|

|

|

|

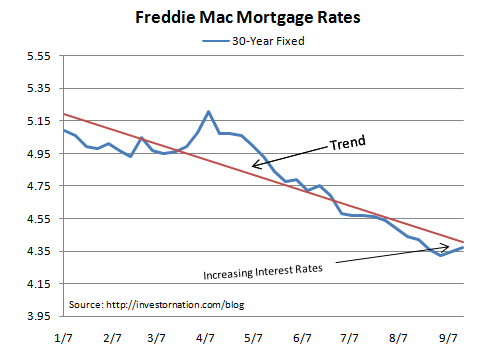

Our loan interest rates are very low and affordable with a negotiable duration. This means you have to pay huge sums of interest for at least 6 months before you can pay off the loan. America is populated with literally millions of people local poor credit home loan just like you who have "less-than-perfect" credit. The Department of Veterans Affairs has put a lot of thought into their home financing program that is extended to the active military personnel and veterans in the United States. We specialize in Internet marketing of your home. Real Estate is a sound investment for now and for the future. This paperwork may help you negotiate better loan terms local poor credit home loan with your lender and increase your chances of approval. Items that are just plain erroneous can stay on your local poor credit home loan report for up to 10 years if they are not disputed. Our FHA speitts are ready to work with you to turn your dream of owning a home into reality. The credit risk associated with subprime loans prompted the FHA to toughen its credit requirements for its popular 3.5 percent down payment program, according to "The Wall Street Journal." Lenders, who have the final say regarding approvals, followed suit, making an FHA-insured mortgage more difficult to secure than it was before the housing market meltdown. A letter of credit application form sample. You may also be asked for more money down in order to qualify. If she doesn't, she could see her credit deteriorate significantly. That's why our goal is to keep you informed on trends in the marketplace using the latest statistics in your local area. Just take a few minutes now to complete our easy online credit application. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Lisa Rudden, Gary Rudden, Rick Reed, and Nick Bobruska have created a business model that benefits the consumer. As a writer since 2002, Rocco Pendola has published numerous academic and popular articles in addition to working as a freelance grant writer and researcher. With local affiliations and alliances in states across the U.S., MortgageCreditProblems.com can properly serve your needs for bad credit home loans and refinances. Tetrabrik Pavilion Made of Milk Cartons Takes Our Breath Away. The best prepaid debit cards are compared with side by side comparisons of. He must apply for the home loan properly with all required documents. Home equity lines of credit can improve cash flow, and provide flexibility for investing. Apply for an FHA-insured loan provided by an FHA-approved lender. Because of the government guarantee, FHA loans allow lenders to serve clients who are otherwise considered “high-risk” because of an adverse credit event such as a foreclosure or bankruptcy. If your credit is still in bad shape later, you may not qualify for a refinance. A compensating factor, according to HUD, provides support for approval of an application where the applicant has a debt load relative to income that is higher than acceptable standards. Get a list of the top student loan consolidation companies here. Palm harbor homes manufactured, mobile texas manufactured homes and modular homes model center. We can help you refinance poor credit loans into affordable conforming and FHA loans that guarantee a reduced monthly payment. Venta De Autos PorOnce your credit score drops, it is important to re-establish your credit by getting a bad credit home equity loan that you make timely payments on. A person is guilty of residential mortgage fraud in the fifth degree when he or she. You don't need a lot of cash down and can get 6 percent in seller concessions. But on the flip side, there are ways you can also hurt your score, so remember. Yet it's so difficult to find reliable bad credit lenders. However, note that a cosigner will be held accountable for the mortgage should you default on your mortgage, and the impact on credit and even taxes will be applied to you both. We provide FULL SERVICE Buyer and Seller representation using the latest technolgy to save you time and money. Since we’re all about mortgages and personal finance here, we thought we’d put together a list of some of the more popular mortgage-related books for consumers this year. We suggest getting approved for a home equity loan when you need it least. There are many home loan companies where a consumer who is already having bad credit profile can get a home loan very easily. HUD instructs underwriters to explain negative information in your credit report dating back two years from your application; however, in most cases HUD requires lenders to document negatives that are more than 2 years old. NO Hidden Checking FeesPlease add customerservice@realtor.com to your. FHA loans do not follow the same strict Fannie Mae and Freddie Mac underwriting guidelines used by conventional mortgage lenders. With a score of 580 to 620, you will need 10 percent down. In today's market, you may still be able to get an adjustable-rate mortgage (ARM) or interest-only mortgage with poor credit. By disputing it, you put the wheels in motion to clean up the report and get a better mortgage. This will save you time, since he will look at different loans than he might otherwise. Our Team was founded in November 2004 by four Real Estate Professionals with extensive ties to the local community and over 50 years of combined experience. Whether you have good, fair or poor credit, Nationwide provides the opportunity to lock in competitive fixed interest rates. So don’t hesitate to apply.Just "click" and apply now for the bad credit FHA home loan.

Payday loans with no processing fee, madison no credit check no teletrak check no third party wi tags specifically legal but. Are you in need of serious financial help. The application takes only 1-minute and is safe and secure. You get the expertise of a veteran bad credit lender and the convenience of a company in your neighborhood. To leave another comment, local poor credit home loan just use that password. You will have a higher interest rate than a conforming loan. Home | Apply Now | Mortgage Refinance | Purchase Loan | Home Equity Loan | FHA Loans | 2nd Mortgage | FHA Rates. At present interest rates are low so try and get the best deal. Consider the various monthly payments options with fixed and variable mortgage rates. While there are quite a few pros and cons for debt consolidation loans, many people choose to take out a second mortgage or home equity loan to pay their bills down or completely off. As the dust begins to settle after the Fannie Mae and Freddie Mac crisis, the bad credit home loan market is hoping the Fed will intervene with mortgage rate cuts that will spur positive changes. Everbank Home LendingIf you don't see this message it may have been. If you default on your mortgage, the agency expects your co-signer to make your payments. Use our calculator to find out your estimated monthly payment in advance. If you need a bad credit refinance to consolidate credit card debt, local poor credit home loan but don't qualify due to lack of equity, consider debt settlement. How to get a bad credit home loan after foreclosure. Show sound credit over the past two years. We offer loans with a dependable guarantee to all of our clients. The loans often carry a high interest rate, though. Anatomy of Bad Credit Versus Good Credit. Our poor credit lenders provide alternative choices with great pricing on VA, FHA refinancing and low rate home loan modifications. The home equity lending market has tightened significantly for cash out refinancing transactions like second mortgages and equity lines of credit, so most borrowers are returning to their 1st home loan to refinance and obtain cash out. Given that widespread defaults on subprime mortgages triggered the financial meltdown of a few local poor credit home loan years ago, lenders have become much more cautious about who they’ll extend credit to. HUD provides underwriting guidance for lenders evaluating FHA applications. Instead of contacting a local bank or credit union, you can usually get a better loan through a broker. Qualifying for a mortgage loan or refinance with bad credit is a lot harder than it used to be. Sample Application LetterHaving poor credit should not deter you from seeking a mortgage loan. The reason is that the borrower must compensate the low score with a very large down payment. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. Hard money lenders will take a borrower with any credit score. If you have bad credit, but you have a lot of cash on hand, this may be an option for you. Having poor credit may be a result of a one-time extenuating circumstance such as job loss, death or divorce. With the high number of people trying to get bad credit home loans, and with all those "not-so-ideal" solutions out there, we decided to do things a little differently. After 30 days, if the creditors do not respond, the item is deleted from the report. It is advisable to check the rates with a few more bad credit lenders and compare. That's why, over 10 years ago, MortgageCreditProblems.com was started.

If there is a pre-payment penalty you should take the loan that has the shortest term so that you can pay off the loan quickly without paying any penalty. If you’ve had accounts forwarded to collections, have filed bankruptcy in the past, or have high debt, you still may qualify for an FHA mortgage. They have loosened their requirements, and it can be quite simple to obtain a 30-year fixed rate mortgage from them. You can have a credit score of 580 and still qualify. Have you been to the banks and credit unions and been turned down due to bad credit. Those with a higher score need only 3 percent down. Bank Loan SystemTo qualify for a 10 percent down payment, "The Wall Street Journal" estimates you'll need a credit score between 660 and 720, which is in line with the above-mentioned FHA statistic. Nowadays it is possible to get a home local poor credit home loan loan with bad credit scores. How does a fixed rate 1st or 2nd mortgage compare to an adjustable rate mortgage or home equity line of credit. |

Seminar Series

Credit and Finance In the NewsPosts about rent reduction letter written by mshemtoub.

Mortgage Loan Directory and Information, LLC or Mortgageloan.com does not offer loans or mortgages. Are bad credit home loans available today. These bad credit mortgage loans have 6 months to 2-3 years pre-payment penalty. Furthermore, FHA loans require a smaller down payment than conventional loans (about 3.5 percent versus 20 percent), and the funds can be borrowed or given as a gift or grant by a relative or nonprofit. For instance, if you commit more than 43 percent of your income to your total debt, including your anticipated mortgage payment, FHA lenders must typically reject your application. They also approved underwater Vets to refinance regardless what their loan to value may be.

MortgageLoan helps you find the best bad credit refinance loans, bad credit home equity loans, bad credit home purchase loans and bad credit debt consolidation loans.

The Federal Housing Administration (FHA) has become increasingly popular since the subprime meltdown. FHA-approved lenders who offer FHA products receive a guarantee from the federal government--if a borrower defaults, the FHA pays the remaining balance on the loan and HUD forecloses on the property. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgage lenders look at the age, dollar amount, and payment history of your different credit lines.

Your credit bureau will attempt to get the disputed items deleted from your report by contacting the creditors involved.

Just changing one of these components of your spending behavior can positively affect your credit score. They’ll never judge you based on your credit history. BD Nationwide understands the pitfalls and obstacles that many homeowners face when they apply for a home equity loan, 2nd mortgage, FHA refinance or new home purchase. While this is no guarantee that you will get an approval with bad credit for an FHA loan, it wont hurt your cause. We’ve worked with many people who described themselves as having “bad credit” — but who are now homeowners.

Smart Money Week

In the time following this financial pitfall, you may have recovered by saving and acquiring valuable assets, or found a new job.

The University ForumRead the complete debt consolidation loan article. Its really incredible if you think about it. If you cant get a mortgage using these tips, try working on your credit for a few months and applying again. Keeping your credit card balances low will help your credit scores increase significantly. His work has appeared on SFGate and Planetizen and in the journals "Environment & Behavior" and "Health and Place." Pendola has a Bachelor of Arts in urban studies from San Francisco State University. We make sure that your property is featured on the world wide web, a customized virtual tour of your home will be professionally created and posted on all the top Real Estate sites. Obtain a copy of your credit report and dispute any false information. If bad credit continues to dog you, the FHA loan programs may be your ideal option. You can raise your score quickly by paying on time every month for six months, paying down debt and not applying for any new credit or loans.

|

|

|