|

|

|

|

|

Student Loan Debt | Credit Card Debt | Debt Consolidation | Budgeting Tips. For a personalized solution to debt relief, contact one of our Counselors and see how we can help you regain control of your debt, and your life. ReadyForZero is a company that helps people get out of debt on their own with will debt consolidation help a simple and free online tool that can automate and track your debt paydown. In many cases, debt consolidation does not have a negative impact on your credit. This article is part of our Debt Consolidation Resource Center. At GreenPath, debt consolidation is a strategy for combining all of your creditor payments into one periodic deposit to your debt management program. Featuring cars for sale in trinidad and tobago and the caribbean. While the initial interest rate may be lower, because you are extending the length of the loan will debt consolidation help (with lower payments), you may end up paying more in interest than you would have otherwise. Be very careful of debt consolidation companies. However, this condition can be reversed if you are paying regular monthly payments and avoiding new debts. Any details about this, like interest metrobank car loan rate rates and other attractive offers. Debt Help From A Professional Debt Management Company. When you choose a consolidation loan, you should look for a set interest rate and an unsecured loan. For online service, 24/7, use the Credit Card Debt Analyzer to calculate your estimated will debt consolidation help interest and payment savings available, through our debt management program. Mesa apartments rent an apartment search mesa apartments in mesa, arizona and earn up to. Sometimes called debt consolidation, this program consolidates your debt payments into convenient deposits to us. The consolidation process is the easiest and safest option to get out of debt. Here, a debt consolidation attorney can help you understand the laws clearly. This will diminish the negative effects on your credit report, paving way to boost your credit score. And by grouping all your loans into one larger loan, you can often obtain a lower monthly payment or lower interest rate. Some of these are scams that hurt people when they need help most. If you are interested, your counselor will also discuss a debt management program. Debt settlement is another frequently misunderstood term. For your initial debt counseling session, it helps to have your creditor statements and other documents handy, as well as a copy of your credit report. Moreover, a lawyer can also assist you in any legal issue that may appear in future. If you are knee deep in debt and thinking of filing bankruptcy, you should consider all your options. Whenever you enroll in any debt relief program, it has an effect on your credit rating. Generally a debt consolidation loan will take unsecured debt and change it into secured debt. In the current tough economy, even the most prudent consumer can find their financial health suffering, and that’s as true of Wisconsin residents as it is of our other customers throughout the country. Sometimes, debt consolidation means taking a loan at a lower interest rate to pay off several smaller loans at higher interest rates. Nor can they charge sky-high fee upon the cash-strapped consumers. You'll have to pay a fee after a written agreement has been signed, a payment plan has been agreed upon, and the creditor has received minimum one payment. Your new credit report will now show that you cured the defaults and retired the debts. You can manage your debt yourself by taking a big loan from a bank at the lowest interest rate and then paying the smaller debts from that loan. Our mission is to provide practical debt relief solutions will debt consolidation help to help others free themselves from debt too. Search credit cards and reviews about the find top low interest student cards best low interest, balance transfer,. Finally and most importantly, get you and your family help with will debt consolidation help the emotional stress and fear that goes with debt like this. Bankruptcy should be your last resort to get out of debt. American consumer credit counseling can help you reduce debt though debt. These companies mainly thrive on donations made by various individuals and companies. If you do decide to take out a consolidation loan, you need to stick to your budget. If you’re in a situation where you need debt consolidation to help you avoid late payments or exorbitant interest fees, the loss of a few points off your credit score due to the hard credit check is probably not your biggest concern. A debt consolidation loan can help you control your debt by lowering your. For example, if you have three credit cards with interest rates of 12%, 18%, and 25%, you might be able to consolidate those three accounts into one loan with an interest rate of 10-15% – which would save you money. Once you have a debt consolidation loan, as long as you make payments on time and adhere to the agreements of your loan, your credit score should only improve.

Check out the following tips that can help to select and work with the best debt consolidation company in your state. CareOne’s founder, Bernie Dancel, was once in debt himself, as were many of our employees. If you or your spouse works for a large company you may qualify for counseling with the company's employee assistance program. Or wondered what the heck a will debt consolidation help debt consolidation loan is. In this plan, a credit counseling agency or the debt management company deals with the creditors to lower the interest rates on the unsecured debts, and develop an alternative repayment plan. Rather it makes a positive influence on your credit score. More than million american adults start up finacing no fico score have no credit history source. Often people will take out a home equity loan or a second mortgage as a way to consolidate their loans. Are you having hard times with will debt consolidation help your overwhelming debt burden. Debt consolidation is legal as long as the companies offering this program or service follows the FTC, state and federal rules. We think one of the best options for debt consolidation is through a peer-to-peer lender. The contents of this web site are not intended to establish an attorney-client relationship, provide the reader with legal advice, or substitute for legal advice from an attorney. And you have only one open account--your consolidation loan. You can learn how to buy a car with zero down car loans no money down and bad credit. There are two ways to get relief from over burdening debt. Bankruptcy damages your credit will debt consolidation help score by 200-250 points. In such a situation, it will be wise to get debt consolidation help from a professional company. The CreditGUARD Coach can help you understand your credit profile and show you how to improve your credit score. However, if you do not have any inclination to consolidate bills, then you may resort to other debt relief options which are listed below. GreenPath pays your creditors on your behalf and works with them to stop collection calls, lower interest, bring your accounts current and waive late and overlimit fees. Refinance Loan OptionsYour post has those facts which are not accessible from anywhere else. As long as you stay current on the consolidation loan payments, your credit rating will be viewed more favorably than before. A debt consolidation loan does not address the real problem, which is spending more than you make. A reliable and expert debt relief plan will minimize the negative effects on your credit report and will improve your credit score. Your counselor will thoroughly assess your household income and expenses, find places for you to save, and develop a customized budget and action plan for achieving your financial goals. Remember, your goal is to manage your debt by making your payments more affordable. Enrolling in a debt relief program will not improve your credit score immediately, but as you continue to add positive information on your credit report, your score will start increasing. |

Seminar Series

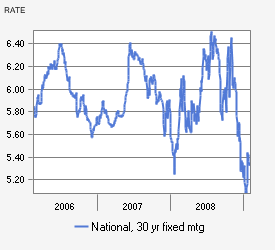

Credit and Finance In the NewsFast, same day, no hassle, no fuss online direct deposit cash loans payday loans on our internet website.

Making one payment instead of many may help you keep your debt under better control, make it easier for you to make timely payments, and thus improve your credit rating. Do not need collateral and have high interest rate. Many balance transfer offers give you a 0% interest rate for six to twelve months (after a 3-5% initial fee), which is great if you are able to pay off your debt in that timeframe. Although debt consolidation has its advantages, you must recognize that by extending the time to pay off your debt, you will ultimately be paying more in interest charges. If you are incurring penalties because of missed payments and need more breathing room, then a debt consolidation loan can help you tremendously. Generally, the effect of personal debt consolidation on your credit score is better than that of bankruptcy.

Debt consolidation programs are services offered by professional corporations in order to help you consolidate several unsecured debt into a single monthly payment.

However, it’s important to keep in mind that a lower monthly payment means you’ll pay more interest in the long run. Our goal on this blog is to assist you in understanding complicated financial questions and to help you make good decisions when you’re working to pay off your debt. It might be a big question for you that why to go for debt relief plan. And they often give you better interest rates than you would get from a bank.

They will guide you through the variety of debt consolidation options available to break the cycle of debt, depending on your individual situation.

For example, if you have 10 accounts in default on your credit report, your lenders will consider you a bad credit risk. You can do this by lowering your interest rate or increasing the number of months you have to pay off the debt. If so, then debt consolidation might be the option for you. It is a chance for you to receive free, impartial advice from an experienced, professional credit counselor without a sales pitch. After you do this, you only have one payment to make instead of several.

Smart Money Week

There are no charges for a GreenPath debt counseling and coaching session.

The University ForumFor example, the consolidation companies cant charge any fee before signing any contract with the consumer. An accountability partner will make it easier to stick to your budget if you must report your spending. Although managing your debt will improve your credit record in the long run, consolidation can have a more immediate impact. The key purpose behind debt consolidation programs is reduction in the overall debt burden by cutback in the interest rates. Otherwise, youll end up back where you started. Most people who take a debt consolidation loan will run their credit card balance back up within two to three years. Debt settlement refers to paying a creditor less than the principal balance. You need to be careful with these because the interest rate is usually very high. Debt settlement companies often charge very high fees for something that you can do yourself for free.

|

|

|