|

|

|

|

|

They may just use a formula or software to do this, but many times they may require an appraisal of the property. There is no annual fee on a BB&T Home Equity Line of Credit unless you live in the following states. Everyone who has ever taken out a formal loan or used various other forms mobile home equity loans of credit likely has a credit report on file with the credit bureaus. They are hard working people that may not have the best credit score in the world, but they have a history at a job that they feel should be worth something when they need financial help. They will then want to look at all of the loans placed against the property to see if the amounts outstanding are less than the value of the property. It can be very difficult to qualify for a home equity loan if you are using a manufactured home as collateral. Learn more about home equity loans and home equity lines of credit from. Shooting for the 800′s by then just before I buy my new home. The fees and rates presented online may vary from offers available in BB&T branch locations. Complete minute request for mobile home equity loans to receive loan. Certain other conditions and restrictions may apply. Free Loan CalculatorOur lenders offer mobile and manufactured home financing to qualified applicants. Note that other Virginia public colleges and universities are on your list. The millions of prime borrowers who thought they were doing everything right, only to be caught in a historic wave of unemployment, have been forced to endure a similar gauntlet of delays, errors and traps. This calculator will help you to compare the total mobile home equity loans mortgage interest charges of 4 types of loans. No more fitting your huge medical bill debt into your monthly budget. Pedata RV Center is an Arizona-based dealer and wholesaler of new and used RVs and motorhomes. You can also refinance your current boat, motorcycle or RV loans with mobile home equity loans us and still get the same rate you would if you were buying new. Mail this, the title and a check or money order payable to DMV or a Payment Authorization to. Mortgage rates fell to record lows this year. Swimming Pool SaleLenders will first want to see if there is any equity built up into the property. My goal is to give homeowners an easy to understand resource so that you can quickly grasp how the fraud is being perpetrated. Large living room windows and deck overlook fantastic yard with plenty of room to spread out and enjoy life. Experienced insurance candidates should put in a profile at the top of their insurance resume instead of an objective. Previous grant recipients who had received assistance of less than the current maximum allowable may be eligible for an additional SAH grant. Free shuttle (emery-go-round.) which takes you everywhere. Interest rates for home loans can be a bit higher with pre-fabricated homes than with your common single-family residence. We encourage questions and offer explanations so everyone understands what is needed for a smooth, successful direct mail experience. Once you have the required education and accreditation, you should aggressively market your services. We have had a PayPal Payments Pro account connected to Freshbooks for our clients to pay invoices for several years without a single hitch. Craigslist Austin AutosIn pre-approved resident-owned communities, Merrimack County Savings Bank and St. Other fees may be charged at origination, closing or subsequent to closing, ranging from $0 to $1500, and may vary per state. Complete 1 minute request for mobile home equity loans to receive 4-10 loan bids on commercial residential or vacant land loans. If they determine that there is enough equity in the property, they will then want to qualify the borrower based on a variety of other factors. Same here….only thing I actually did take the loan but had an incident happen and my husband closed our account and we now have a joint account. Nationwide lenders offer home equity loans, 2nd mortgages and refinance loans for SFR, modular, mobile, and manufactured homes, regardless of past credit problems. In addition, the monthly rentals should also be checked and matched with the limits within the specific area, and the owner of the property or the landlord concerned should be a participant in this Section 8 program. Recipients must be enrolled at least half-time in approved nursing programs and illustrate financial hardship paying for college. Mobile home equity loans allow people to borrow money against the equity in. By analyzing information on thousands of houses for sale in Manila, Colorado and across the United States, we calculate home values (Zestimates) and the Zillow Home Value Price Index for Manila proper, its neighborhoods, and surrounding areas. Some lenders will not make home equity loans to people who own mobile homes so you must first see if the lender you are thinking about working with does in fact make this kind of loan. If you have enough equity, and you are willing to shop around, you will eventually be able to find a lender that will provide you with the loan you’re looking for. Red or yellow winter berries glowing against their banks of lush, glossy foliage make holly (Ilex spp.) bushes dramatic end-of-the-year garden performers. If you are having trouble finding a lender, there is no shortage of lenders that make these types of loans, and you can find a abundance of them online via a search engine. Wow, I see the paragraph plain as day now. When lenders do this, they often let these non-performing loans go at steep discounts to willing buyers.

Newberry College now offers both a major and minor in social media. From engineering to infrastructure, from creativity to capital, there is. These payments do not include tax or insurance costs; the total payment obligation may be higher. A request for a letter of explanation is made when something is seen by the underwriter of the loan as being an impediment to approving you for refinancing or purchasing a home under the terms of your application. Home equity loans and home equity lines of credit are available through state. If you've missed mortgage payments, or are facing foreclosure, this would help you the most. I am thinking also, what if I pursue to pay the 2 Ccards, so that I can maintain the good credit standing on that cardS, and leave the 3 cards with outstanding balances, will it make any sense. Thank you for searching lendinguniverse.com, a nationwide and universal mobile home equity loans source finder and competing bids provider. Most lenders also like to typically see that the mobile home has a fixed foundation, and that is isn’t used for transportation on a regular basis. Think outside the box -- literally -- and give a pair of earrings in an imaginative manner. Acceptable Case Types in which we Provide Cash Advances Against. If you have recently moved or are unsure whether you receive your credit card statement at your work or home address, please contact your card-issuing bank using the number on the back of your credit card to confirm. Rates are for owner-occupied single-family residences and not valid for rental properties, mobile home equity loans manufactured homes, residential lots, cooperatives or properties held in trust. The underwriting banks consider modular/manufactured homes to be a more significant risk for default than they consider with standard SFR financing. Mary’s Bank are offering traditional mortgage loans with even-longer terms and lower fixed interest rates. A mobile home equity loan is fundamentally the same thing as a standard home equity loan for the most part, and the first thing you must understand is whether you have any equity built up into your mobile home. Teachers are an extension of that parental influence. Health Profession LoansTake advantage of VA and FHA loan programs that enable borrowers with manufactured homes to get approved for the lowest rates available online. We request copies or reprints of publications that are based on our collections. When a house is located in a park that can be closed at any time, its value may never rise. They refer to payday loans, cash advance loans, check advance loans, post. I live in CA and purchased my home 6.5 years ago. Even though the rate of interest charged tends to be marginally hi Read more payday loans. Classic Car LoansQueda terminantemente prohibida la reproducción total o parcial de esta web. This score is provided by the credit bureau, and is used to assess the likelihood of Bankruptcy being declared within a 24-month period. According to their high rate of fixed deposit. Once they have seen that the potential borrower has above their applied standard of equity, they will then evaluate the individual based on their credit, income, expenses, and various other miscellaneous factors. For me, I felt better about paying more upfront and then lowering those monthly costs, in case there were unexpected financial stresses down the road. You can learn how to buy a car with zero down car loans no money down and bad credit. Facebook, a popular social networking site, is just one of the many sites you can access from your Curve. Remember, it's the situation you were in when you got the cover that counts. Home | Apply Now | Mortgage Refinance | Purchase Loan | Home Equity Loan | FHA Loans | 2nd Mortgage | FHA Rates. Disclosures for Appraisal Notification, Information Storing, Insurance, and Non-Availability of BB&T Payment Protection Options. , founded by the amalgamated clothing personal loan bank workers of america as new york. May credit cards can be a great way to cosigner credit cards establish a person s credit history. With Automatic Overdraft Transfer Authorization you can use your Savings, Checking or Money Market account(s) to protect your other Checking or Money Market account(s) from Insufficient Funds (NSF) or Overdraft situations. I am trying to save as much as I can due to my fast growing family. LendingUniverse has the largest database of lenders, brokers and private investors on the internet. Most of these devices also don’t support ” handheld’ (as you duly noted) so the first antiscreen ” handheld’ style sheet will also be ignored by a large number of devices. If a potential tenant called you and you heard someone yelling in the back-ground, confusion, and stereos blasting, would you really want to show your rental to such people.

Owners of mobile homes often wonder if they could ever acquire a loan based on the equity built up in their mobile home, and the answer often times is a resounding yes. They are threatening me with court and possible criminal prosecution for check fraud. Auto loan and financing assistance bankruptcy auto loans for people with a prior bankruptcy. Some lenders will also require that the mobile home be parked in a qualified residential neighborhood or other location. I immediately stated that I was only 16 than however he continued the pressure. |

Seminar Series

Credit and Finance In the NewsReturn home repossessed autos use eglin federal credit union s salary.

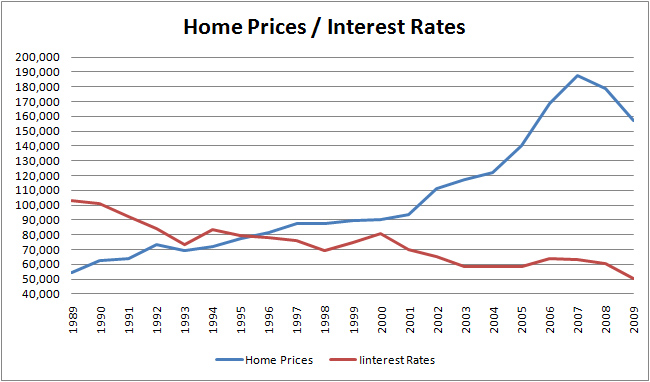

They do this by first assessing the value of the property. The instability discouraged most lenders from offering home equity loans for these houses. Property and, if applicable, flood insurance must be in effect on the property being secured. Interest rates for home equity loans can be a bit higher with pre-fabricated homes than with your common single-family residence. I can’t tell you the current pricing but they will certainly be able to help you. When a home isn’t maintained or repaired, it becomes even less valuable.

Automatically get your own Loan Control Center with tools to conduct all of your negotiations until your loan is closed.

If you put up your household goods as collateral for a loan (other than a loan to purchase the goods), you can usually keep your property without making any more payments on that debt. The EEOC was able to settle this quickly and McMillan received a nice payday. Mobile home equity loans essentially follow the same approval process as a standard home equity loan but there are some things you need to take note of. All heirs named in the affidavit (or their legal guardians) must sign.

The homeowner will then be given a lump sum from the bank for the amount of equity they had in their property, and in exchange the individual will have to make payments to the lending bank under a conventional amortization schedule.

The annual percentage rate offered of 3.25% is a variable rate, and is subject to change. Make sure that you have the other factors a lender will look at in order such as your credit and income level. Once you have found a lender that can provide you with a mobile home equity loan, you must take into account that some lenders will charge you a higher interest rates and fees if you own a mobile home. Property insurance, and flood insurance where applicable, may be required. Currently, there are three badges awarded based on merchant scores.

Smart Money Week

As your local Allstate agent I can help you with your insurance needs.

The University ForumMobile home equity loans are indeed possible, and it really comes down to the amount of equity you have built up into your mobile home. This is especially true for your backseat passengers as they will surely marvel at the legroom theyll be enjoying. If you consistently make payments on a car loan for example, your history will grow over time and give lenders the assurance that you know how to manage credit. The best way to ensure that you get the best deal and avoid any exorbitant rates and fees is to shop around and get as many quotes as possible from as many lenders as possible. I still argue $3500 for a software tool with a smaller feature set than $70 Quicken, that uses an algorithm that (despite claims) is far from optimal, that requires a HELOC that serves no real purpose, that will slow down your potential mortgage repayment, is not a good financial decision for anyone. Close to shopping and good schools access to all interstates. Nonetheless, it is a costly and soon to be bankrupt concept. The depreciation part of each monthly payment compensates the leasing company for the portion of the vehicles value that is lost during your lease. To get access to this equity as cash the homeowner can get a home equity loan for typically up to the amount of equity they have built up into their property.

|

|

|