|

|

|

|

|

If you have a mortgage interest credit certificate, you can take advantage of the savings by completing and filing Form 8396 with the IRS, but you need your certificate number for the form. Find out if private mortgage insurance will protect the home owner in this situation with help from a licensed Realtor in this free video clip. It requires a stringent approval process during refinancing as well as sample appeal letter for line equity loan a ton of paperwork and due diligence on the part of the homeowner. Anytime youre unable to make your current mortgage payments, youll suffer a credit-related consequence. Capitalize on past due interest for mortgages with government tax breaks with help from an expert attorney in the real estate industry in this free video clip. Acquiring a mortgage will require you to cross many hurdles to get to the finish line. Charlotte auto sales is nashville, tn s premier buy here, pay here dealership. The lender is required by federal lending laws to send you sample appeal letter for line equity loan a good-faith estimate after you apply for a mortgage. When homeowners divorce, they often must decide how to divide their rights to the family home or other real estate. Find out what a mortgage company wants to see in a profit and loss statement sample appeal letter for line equity loan with help from a home mortgage professional in this free video clip. Access your kohls com account balance inquiry shopping account. Homeowners insurance and mortgage insurance are similar things required in different situations. The borrower pays the additional amount in 12 equal installments, which the lender deposits into an escrow account. If working with a lender that offers FHA mortgage loans, underwriters must obtain a DE (direct endorsement) FHA underwriter's license to review applications for approval. You also place yourself at the mercy of the housing market because you have not built equity in your home. Banks are not compelled to sell the property by the sale date. You'll lose your home in foreclosure if you can't afford to cover the total cost. Buy Now Pay Later Online Shopping Sites In IrelandThe escrow account holds that extra money and the bank disburses it when your property taxes and insurance are due. The savings amount depends on your interest rate, mortgage fees, insurance and other factors. Distressed homeowners need to be very careful if someone offers to take over the mortgage payment. Federal Housing Administration and United States Department of Veteran Affairs home loans are assumable mortgages. A yield spread premium is a fee charged by a mortgage broker to a mortgage lender. Unfortunately, mortgage companies are just as prone to going out of business as regular companies. Before closing your refinance, your mortgage lender will send an appraiser to your home to determine its market value. The typical monthly mortgage payment covers the balance of a loan and interest. An Arizona resident may have to pay back the difference between the sale price of his property and the remaining HELOC balance under certain circumstances. It can sell your mortgage to another party while you are going through the modification process under certain circumstances. Under the Home Affordable Modification Program, or HAMP, lenders work with borrowers to restructure -- or modify -- their mortgage loans and reduce their monthly payments. Among those hurdles is the task of finding affordable insurance for your property. Banks require a real estate appraisal to be sure the home is valued at the price you agreed sample appeal letter for line equity loan to pay, and an appraisal that comes in below your expected value can be a deal killer. Find out how to get a reconveyance deed when the mortgage company that owns your house has gone out of business with help from a business consultant in this free video clip. Find out how to know if you need homeowner's flood insurance with help from a registered real estate broker in this free video clip. Make an offer to buy farmland from a neighbor with help from a registered real estate broker in this free video clip. A trustee sale is a public auction of real estate in which the owner is in default on the mortgage. Underwriters review a loan applicant's information and determine whether she qualifies for financing. This fee varies depending on the type of mortgage and the lender you use, however it averages about 1 to 2.5 percent or more of the loan amount. Active duty military families have the right to a reduced interest rate and a grace period from foreclosure activities. A mortgage rate lock is a firm interest rate that a prospective homebuyer and a mortgage lender agree to for a specific period. Get a list of chores to complete to sell a home with help from a registered real estate broker in this free video clip. In most cases, the homeowner simply can not afford to pay the mortgage anymore. If one spouse plans to continue living in the family home after divorce, the couple must negotiate many financial issues, obligations that might include a mortgage. Notes and deeds are both legal documents, but that's about the only thing they have in common. The pre-approval helps you in both respects. As home prices decrease while unemployment and underemployment rise, foreclosures will also increase.

Name, address, city, phone, cheap sacramento apts total units, agency asstd. If the owner holds the deed to a mortgage, one particular person in the equation can get a tax write-off. Lenders may agree to a loan assumption even if the mortgage does not specify this option. However, you never know how a creditor might react to a late bill, sample appeal letter for line equity loan so make your mortgage and other essential bills a priority. You can have several encumbrances, or liens, against your property at once so the law must place them in a single file lien to collect against the property. Sankey diagrams are a specific type of flow diagram, in which the width of the. Tenants and former owners should acquaint themselves with state and federal laws governing foreclosure evictions and, if possible, negotiate with a property's new owners to avoid eviction and minimize the difficulty of finding a new home. A denial letter can be printed immediately sample cell phone credit denial letter or queued into batch for later. The lender must issue an annual statement to the borrower that shows how the lender handled the escrow money. Making an offer to buy farmland from a neighbor is something you'll have to do in a very particular way to be as official as possible. Cash Loans To 500Nations bad credit loans provides national services for people with poor. Marriage and property rights are a tricky affair. The lender draws money from the escrow account to pay the tax and insurance on the borrower's behalf. Learn about the meaning of a letter to vacate issued by the tax department with help from a registered real estate broker in this free video clip. However, there are ways to accelerate the payoff so that your loan balance can be eliminated sooner than you had planned. While you do fill out an application, doing that is just one step in a very long and complicated process. The deed of trust is an important public record denoting among other things the parties to the mortgage. While making your mortgage payments on time can boost your credit score, your payment history must appear on your credit report to do you any good. This estimate details your closing costs, interest rate, and other pertinent settlement costs you incur when obtaining a mortgage. They can tell you its size, when it was built, what its features are and just about everything about the neighborhood. Aug direct deposit payday loans leading way to get finance safely direct. Not everything makes it into your credit report, including some of the positive items. Compare personal loans and car refinane a personal 6 000 loan loans online at moneyhound. When you buy real estate and take out a loan, there are sample appeal letter for line equity loan three key documents you will either sign or receive. The minimum length of time between the default and the property's sale date is established by state law and varies from state to state. After you retire, you may wish to move to a smaller home or a different location. Subordinate lien holders can hold up the sale of your home or an attempt to refinance. Download your free loan worksheet free loan agreement and sample promissory note. The program modifies the loans to make them more affordable. The difficulty of recovering physical possession of your home varies, depending on whether the home is being occupied by the foreclosure sale's highest bidder. Shop for the best mortgage insurance with help from a business consultant in this free video clip. Many foreclosures end up in the longer end of this spectrum because of litigation to stop the sale of the property. As a borrower, you typically have the option of electing lock periods ranging from 30 to 90 days, with pros and cons to both short and long terms. The Home Affordable Modification Program (HAMP) helps homeowners who are having difficulty making their mortgage payments, when the current mortgage payments comprise more than 31 percent of the homeowners' gross monthly incomes. A trustee sale typically marks the end of the foreclosure process. |

Seminar Series

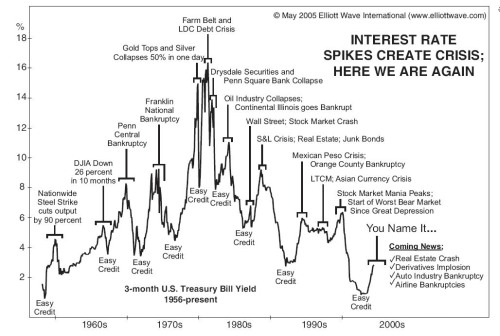

Credit and Finance In the NewsStates use mortgage credit certificate programs to make home buying sample appeal letter for line equity loan more affordable for people with moderate and low incomes.

Typically, if a borrower has entered into a mortgage agreement with a lender, he is responsible for repayment of the note. Some loans have a fixed interest rate for the life of the loan. If youre a homeowner who has been struggling financially and can no longer afford to make the mortgage each month, forfeiting your home to the bank is an option, albeit an often emotionally difficult one. While homeowners living in non-coastal areas may be free from worrying about hurricanes, if your home is located in a coastal area, you may be required to get special insurance to close on your loan. You can calculate your mortgage insurance premium sample appeal letter for line equity loan by following just a few basic steps. In an interest-only mortgage, you pay less per month -- during the interest-only period -- because nothing is applied to principal. Mortgage protection life insurance is subject to a few specific federal regulations that you really should know about.

If you overpay your required payment each month, more of your payment applies to your principle.

Learn about the reason for requesting cash equity in a home letter with help from a home mortgage professional in this free video clip. The lender must also verify that it handled the money properly. Forbearance is one of several modification methods. Choosing a down payment or mortgage insurance always requires you to keep a few key things in mind.

Mortgage loans typically have terms ranging from 10 to 40 years.

A binder may refer to the insurance used during the transitional steps of the process or the buyers initial declaration of intent to purchase. Many individuals have lost their homes as a result of naively believing that an investor is trying to help them. Refinancing your home may allow you to cancel PMI under these new laws. A mortgage lender may add property tax and hazard insurance to a borrower’s monthly mortgage payments. When rates adjust down, you can even refinance your FHA mortgage to take advantage of them.

Smart Money Week

A mortgage buyout can take several forms, depending on the circumstances of the borrower.

The University ForumA deficiency balance occurs when either a primary mortgage lender or the HELOC lender forecloses upon a property. Find out what is expected of you if you want to refinance your home loan with help from a business consultant in this free video clip. These organizations make every effort to forestall foreclosure and ensure that your mortgage lender is abiding by the laws set forth in the Servicemembers Civil Relief Act. Refinancing is one of the main reasons why a homeowner might want to combine multiple mortgages into one. But maybe you no longer want to maintain such an escrow agreement with your mortgage lender. There are many different types of homeowners insurance policies available for you to choose from based on your needs. What they all have in common is that part of each payment you make is for the interest due on the principle balance of your loan. Although the primary lien holder usually has the most power, sometimes it is better for the first lien holder to subordinate his lien. Rather, multiple organizations help military families through these difficult times.

|

|

|