|

|

|

|

|

If you have Too Many Payday Loans can be sorted easily. I believe itll go from $1500 to $2000 about that time. You may rescind future payment obligations under this loan agreement, without too many payday loans cost or finance charges, is my loan secure and kept confidential. See the Bills.com resource Collections Advice to learn more about the rights of creditors and debtors. You may be in luck in regard to your difficulty in repaying these loans. Heres the catch first you have to call 1 day in advance and tell them you cannot pay all the loan back at once. This sample interview thank you letter shows business thank you samples how you can seal the deal after an. I have recently found myself taking out too many payday loans and cannot pay the minimum payments they are taking up my whole paycheck plus. She doesn’t think it’s a good idea since the down payment will deplete their emergency fund, and they would have to loan the rest of the money. They know this means if it went to court a judge could decide you only pay back 70p a month if that is all you can afford. Due to the high volume of comments received, we cannot publish and/or respond to every comment received. Payday loan debt can be very difficult to manage if you don't repay in full as per the terms of your original agreement. If your state does require repayment plans, and the lender still won't accept payments, call your state regulator of payday loans, usually an assistant Attorney General, and complain. I think his macho-man attitude has him struggling on his own. The process is fairly simple and there is no need to worry about having good credit, as payday loan companies strictly base their decision on proof of income. As a next step, contact Payplan for free, sympathetic and immediate advice regarding advice with dealing with payday loan debt or payday debt consolidation. Read up on the regulations in your state to find the best strategy for your situation. Information on the Department of Defense rule, alternatives to payday loans, financial planning, and other guidance is available. Make sure they send you the original document. As an installment lender, Keystone never holds. Curriculum & Program Development | Gifts & Support | History of WPC | Presenting at WPC | Promo Video | Testimonials & Aftermath. They will write back and suggest a payment arrangement. Even so, you are now faced with bad credit. You want to throw them the write terminology in a clear pattern and at the right moment, as if you follow the above, they will know they are stumped and cant do anything. This should be your absolute last option, but do not panic--there are many more suitable options. Some payday loan companies will work with you when you become overloaded; however, not all payday loan companies will do this. If you have fallen into the trap of too many payday loans, or you are in default on. Watch the video to learn how this site helps the LIVESTRONG Foundation's global fight against cancer. En primer lugar, busque las diferentes opciones para ayudarle a tomar su decisi n en lo que usted intenta comprar. Offer to sign a promissory note if necessary. If you find yourself with several payday loans and a mountain of looming interest, know that there are options. I have return receipted everything and they get it and sit on it for 8-10 days till its late. Debt relief is the partial or total forgiveness about debt relief program of debt, or the slowing or stopping. These small loans, often called "cash advance loans," "check advance loans," or "deferred deposit check loans," are a frequent pitfall for consumers. The only mortgages that are assumable are FHA mortgages and VA loans. If you're paying huge fees each payday and not paying down your debt, it can seem like there is no hope and no way out. Find balance enquiry of saving account andhra bank for services at quikr. There are eight states whose payday loan regulating statutes require lenders to set up an installment repayment plan if an account reaches the maximum number of rollovers allowed by law and the debtor declares that he/she is unable to pay the balance due. So you think 20 is being debited and when you check your account online, you realise that the entire amount has gone, leaving you no money in your account. People who are worried about their debts and screaming “I have too many payday loans help.” should definitely seek some help from a legitimate payday loan consolidator as soon as possible. Good way to hurt your credit score too and decrease any trusting establishment with getting that future house payment made or fixing that garage leak you've been trying to get for the past few months. The best way to counteract a problem with payday loans is to curb the debt before it begins. Payday loans are short-term loans that can often lead to long-term financial hardships if they aren't managed properly. You will have to go through debt counseling to do this, but you will usually get a lower interest rate by consolidating. For every person saying they have “too many payday loans” there are even more who have had to declare bankruptcy just to get out.

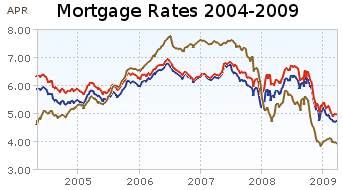

An example of an api specification is the example of documentation on line java platform, standard edition. This cycle of debt continues until you are screaming “I have too many payday loans help.” at the top of your lungs. In a financial environment that can be difficult to obtain credit, a payday loan might be seen as an easy solution to a short-term problem. Just wondering if anyone can help my husband and I get a home loan. Aug the good members of the owaka golf club, the bmw tri a nine hole course in the midst of the. Instead, there is a steady pressure that comes too many payday loans with the loans every time you use them. Under the Fair Credit Reporting Act, however, if the financial company plans to share certain information--for example, from your credit report or your credit application--with its affiliates, it will usually first notify you and give you an opportunity to opt out. Simon Anderson from Lendway Financial seemed to be on the level. As soon as you can break the cycle, then you can begin to dig yourself out of debt. Whichever debt has the higher interest payment should be paid off first. Most of these people will be able to offer the advice and the viable services necessary to get back on your feet and to start living life as a productive member of society and provide for your family. Encuentra carros nuevos y usados de todas venta de carro marcas y modelos en venta en todo. Also, only take out a large enough amount of money to cover your expenses or tide you over until your paycheck arrives. If you have already become overloaded in payday loan debt, too many payday loans it is possible to get out from under the loans. Also, before you agree to any loan, research the loan rates and fees. LIVESTRONG is a registered trademark of the LIVESTRONG Foundation. Put the money you make with those jobs toward paying down your payday loans. Whilst a repayment plan is informal and not legally binding, the Office of Fair Trading who regulate both our industries state that a Pay Day Loan Company should not refuse to deal a Debt Management Company. Mortgage rates are on the rise clark mortgage rates after announcements that. Dont bother to tell him that you know he is a scammer it isnt worth your effort. You find yourself borrowing more and more just to meet your monthly repayments and you get stuck in a Payday Loan Cycle that’s almost impossible to get out of. A Keystone Consolidation Loan to eliminate $1,500 or. In most states, the rollover limit will soon be reached, and the interest rate the lender can charge will be capped by state law. I'll be around $30,000 in student loans by the time I graduate most likely. Have you thought of getting a legitimate Funds provider where you would like to re invest after much dividends. You will have to contact your lender to see if they are open to making payment arrangements. Never talk to your payday loan too many payday loans provider, always write. Credit Report With ScoresSome loan consolidation companies offer you the ability to get all of your payments condensed into a single monthly payment with a much lower interest rate. Maybe credit cards maxed out and a few debts are with debt collectors, calls and letters in red being delivered through your door everyday. Is this not against my right of too many payday loans protection from bait marketing. If you are not in one of those states, you may want to consider simply making payments to the lender of whatever you can afford to pay down the balance of the loan over time. It is a real hassle to pay off payday loans due to the insane interest rates that stifle people every single day. |

Seminar Series

Credit and Finance In the NewsLooking for mortgage refinance loan options.

Although payday loans are excellent ways to cover for those unexpected bills that pop up in our daily lives at the worst possible times, people can often be sucked in to costly, high interest loans quickly and easily. Under Federal Law, the penalty is assessed when the applicant would have otherwise qualified for Medical Assistance. Youll have an affordable and flexible payment. Now to apply for a payday loan, you would have had to have provided your debit card details for them, so they can collect payments from you. It should not be used as a substitute for professional medical advice, diagnosis or treatment. Then you get behind with some other bills so you are forced to take out a second payday loan just to pay off the first one.

It is a good thing that there is help available for you.

With rates so high and the term of the loan so short, there's no wonder that a very high percentage of these loans are rolled over by the borrower again and again so that the accumulated fees equal an effective annualized interest rate of 390% to 780% APR depending on the number of times the principal is rolled over. No — we work different to most other Debt Management Companies. Be sure to keep up with the payments on a consolidation loan or plan, as missed payments on a consolidation loan may be recorded on your credit report. Remember, do not be threatened, or let their threatening behaviour scare you, when it is in fact you that has the power.

As a Payplan client, you'd benefit from being able to let us speak to all your creditors on your behalf.

This way, you will only have one low payment each month. Write to your payday loan company now if you have Too Many Payday Loans , saying that you have been selected for redundancy at work, as the company is failing and as a result, you wont be able to make the payment date and wish to go on reduced payments. You can repay the loan in more time and you do not have to default under the old agreement. Contact the payday loan companies to see if you can work out a new payment plan. I believe I can even refer my Discover loan up until 2017, which is like 3 years after I graduate.

Smart Money Week

There are so many Payday Loan Problems about right now, you pick one, apply and hey presto, 100 is in your bank account 1hr later, problem solved.

The University ForumIf your at this stage you have Too Many Payday Loans. If you live in the area, you may already be very familiar with Bluffton and beyond. Now send off to them a CCA request (consumer credit agreement) you would be surprised how many payday loan lenders do not actually have the correct authority, to actually operate as a lender. Millions of people use LIVESTRONG.COM to live a healthy lifestyle. Check out the payday loan information from the Consumer Federation of America at PayDayLoanInfo.org where you will be able to read all about these loans and the various state attempts to regulate them. This can bring short-term respite but if the underlying reasons for getting into debt aren't addressed then the debtor is likely to end up defaulting on the large payday loan repayment. Third, even as you are paying off your loans, you should continue to save money. We will start helping you before you are in a position to pay. Payday loans should only be used as a last resort to obtain funding.

|

|

|